What is Betterment App?

Betterment is an app that offers automated investing services to individuals seeking an easy and convenient way to invest their money. The platform uses advanced algorithms and technology to create personalized investment portfolios based on the individual's financial goals, risk tolerance, and time horizon.

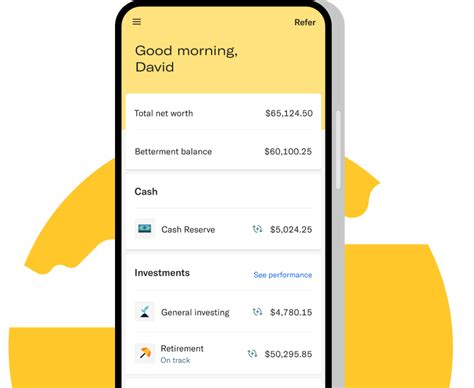

The Betterment app allows users to track their investments, transfer funds, and view their account performance at any time. With no minimum investment requirement, users can start investing with as little as $10 and choose between different account types such as individual or joint accounts, traditional or Roth IRAs, and SEP-IRAs.

One of the benefits of using Betterment is that it offers a broad range of diversified investments that are automatically rebalanced to help optimize portfolio returns. Users also have access to comprehensive financial planning tools and support from licensed financial experts to help them make informed investment decisions.

Another great feature of the Betterment app is its low management fees. With a simple, transparent pricing structure, investors pay an annual management fee of 0.25% of their account balance, which is significantly lower than traditional investment advisor fees.

Overall, the Betterment app is an excellent platform for new and experienced investors who want to automate their investment strategy and take advantage of technology to optimize their returns. With its easy-to-use interface, low fees, and personalized investment options, Betterment makes investing accessible to a broader range of individuals.

Frequently Asked Questions about betterment app

As an independent digital investment advisor and fiduciary, Betterment's mission is to help you do what's best for your money so you can live better. Get started in minutes with just $10 and no minimum balance. Keep track of your financial life across your short- and long-term savings goals with our easy-to-use app.

Betterment has four crypto portfolios, including Universe, a broad crypto offering, Sustainable, a more energy efficient crypto option, Metaverse, which focuses on emerging digital experiences, and Decentralized Finance, a portfolio that features decentralized financial services.

Betterment currently only operates in the United States, and for regulatory reasons cannot accept international customers residing outside the United States. This includes U.S. citizens residing and/or working abroad.

Checking accounts and the Betterment Visa Debit Card provided by and issued by nbkc bank, Member FDIC. Funds deposited into Checking are FDIC-insured up to $250k for individual accounts and up to $250k per depositor for joint accounts. Betterment Checking made available through Betterment Financial LLC.

Betterment helps you manage your money through cash management, guided investing, and retirement planning. We are a fiduciary, which means we act in your best interest. We'll ask a bit about you when you sign up. We'll also gather information when you connect your outside accounts.

Betterment is an American financial advisory company founded in 2008 by MBA graduate Jon Stein and lawyer Eli Broverman. Betterment makes money via investment plans, financial advice packages, betterment for advisors, betterment for business, cash reserve, and checking accounts.

Betterment is an American financial advisory company which provides digital investment, retirement and cash management services. Betterment Holdings, Inc. MTG, LLC. The company is based in New York City, registered with the Securities and Exchange Commission, and a member of the Financial Industry Regulatory Authority.

Betterment uses ETFs in both our stock and bond portfolios because of the low management fees and tax-efficiency they offer. Learn more about the advantages of ETF-based portfolios.

Its only countries of operation are the United States, Puerto Rico, and the Virgin Islands. This means that if you are a resident of Belgium, France, Germany, Ireland, Italy, Poland, Romania, Spain, Sweden, or any other European country, you won't invest through the Betterment app.

Neither Betterment LLC nor any of its affiliates is a bank. Through Cash Reserve, clients' funds are deposited into one or more banks ("Program Banks") where the funds earn a variable interest rate and are eligible for FDIC insurance.

Betterment is a robo-advisor, while Robinhood and E*TRADE are investment brokers. Robinhood and E*TRADE are primarily for self-directed investors. Betterment is for passive investors. Betterment offers predesigned portfolios.

nbkc bank

Checking accounts and the Betterment Visa® Debit Card provided and issued by nbkc bank, Member FDIC.