Capital One (Credit Card) Spark Cash Plus commercials

Table of contents

What is Capital One (Credit Card) Spark Cash Plus?

Capital One is a renowned financial institution that offers a wide range of banking and credit card services to customers around the world. One of their popular credit card offerings is the Capital One Spark Cash Plus.

The Spark Cash Plus credit card is designed specifically for small business owners who are seeking a trustworthy and reliable financial partner. With enticing features and rewards, it aims to assist entrepreneurs in managing their expenses and maximizing their business growth.

One of the standout features of the Spark Cash Plus credit card is its generous cash back program. For every purchase made using this card, users can expect to earn an impressive unlimited 2% cash back. Whether it's office supplies, travel expenses, or even larger investments, business owners can benefit from earning cash back on every transaction.

The Spark Cash Plus credit card also provides a substantial signup bonus, adding even more value to the card. New cardholders can earn a substantial cash bonus after they reach a predetermined spending threshold within the first few months of opening their account. This bonus can provide a significant boost to a small business's finances.

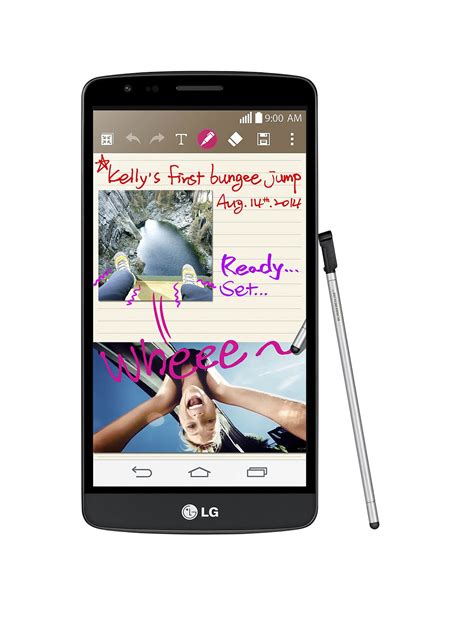

To make managing the card as seamless as possible, Capital One offers a user-friendly mobile app and online portal. Through these platforms, business owners can easily track their expenses, set spending limits, and receive real-time alerts. Additionally, they provide detailed monthly statements that allow users to categorize their expenses, making it effortless to stay on top of their finances.

Another standout feature of the Spark Cash Plus credit card is its flexible redemption options. Cardholders can choose to redeem their cash back in several ways, including statement credits, check payments, or applying the cash back towards upcoming purchases. This flexibility allows business owners to leverage their rewards in a way that aligns with their specific financial goals.

When it comes to security, Capital One prioritizes the protection of their customers' sensitive information. The Spark Cash Plus credit card boasts advanced security measures such as fraud alerts, identity theft protection, and encrypted transactions to ensure peace of mind while conducting business.

In summary, the Capital One Spark Cash Plus credit card is an excellent choice for small business owners who want to streamline their financial management while earning valuable rewards. With its generous cash back program, enticing signup bonus, and flexible redemption options, it has become a sought-after credit card option for entrepreneurs looking to maximize their purchasing power and grow their business.

Frequently Asked Questions about capital one (credit card) spark cash plus

TV spots

TV commercials Capital One (Credit Card) Spark Cash Plus

Advertisers

Advertisers of commercials featuring Capital One (Credit Card) Spark Cash Plus

Capital One (Credit Card)

Capital One is a renowned and widely recognized financial services company that specializes in offering credit card facilities to consumers. Established in the year 1994, the company has consistently...