Aspiration Debit Card commercials

Table of contents

What is Aspiration Debit Card?

Title: Aspiration Debit Card: A Financial Tool for the Future

Introduction:The Aspiration Debit Card is not your ordinary plastic card. It represents a new way of thinking about personal finance and sustainability. With its unique features and social impact, the Aspiration Debit Card offers much more than just a means to make everyday purchases. In this article, we will explore the various aspects and benefits of the Aspiration Debit Card, highlighting how it aligns with the values and aspirations of its users.

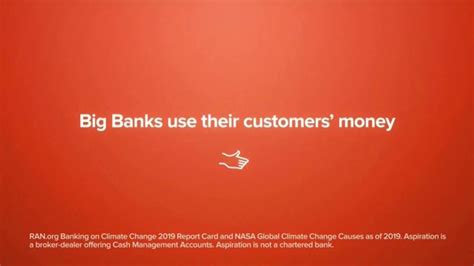

1. Ethical and Sustainable Banking:Aspiration is not your traditional bank. They go beyond profit-seeking by focusing on creating a positive impact on the environment and society. By opening an Aspiration Account and getting their debit card, users become part of a banking experience that contributes to the greater good. Aspiration commits to using deposits to fund sustainable initiatives, such as clean energy projects, environmental conservation, education, and poverty alleviation programs.

2. Fee-Free or Trash the Fees:One of the most significant advantages of the Aspiration Debit Card is its fee-free ethos. Unlike many traditional banks, Aspiration does not charge monthly maintenance fees, minimum balance fees, or ATM withdrawal fees. This fee-free structure empowers customers to save more and spend money as they see fit, without the burden of unexpected fees eating into their finances.

3. Cash Back:Who doesn't love a little extra cash? With the Aspiration Debit Card, users can earn up to 10% cash back on purchases made with socially and environmentally conscious businesses. This cash back feature not only encourages responsible spending habits but also rewards individuals who choose to support companies that prioritize sustainability and ethical practices.

4. Personalized Carbon Footprint TrackingAspiration empowers its customers to make informed choices by providing them with a comprehensive carbon emissions tracker. With every purchase made using the Aspiration Debit Card, users can see the direct impact on their carbon footprint. This feature creates awareness and encourages individuals to make eco-friendly and sustainable choices while spending their money.

5. No Overdraft Fees:Overdraft fees can be a burden for many people. Aspiration is committed to providing financial security and peace of mind to its users by eliminating the hassle of overdraft fees. The Aspiration Debit Card is designed to prevent account overdraw by disabling the overdraft feature. This ensures that users never have to worry about incurring unnecessary and costly fees due to accidental overspending.

Conclusion:The Aspiration Debit Card represents a new era for personal finance, offering more than just a way to make purchases. With its fee-free structure, cash back rewards, sustainable initiatives, and personalized carbon footprint tracking, it aligns with the values and aspirations of those looking for a banking experience that prioritizes the environment, society, and financial well-being. By choosing the Aspiration Debit Card, individuals become part of a movement that aims to create a positive impact, one transaction at a time.

Frequently Asked Questions about aspiration debit card

TV spots

TV commercials Aspiration Debit Card

Advertisers

Advertisers of commercials featuring Aspiration Debit Card

Aspiration

Aspiration is a financial firm that is focused on providing socially conscious options for consumers. The company was founded in 2013, and has grown rapidly in the years since its inception. Aspiratio...