TaxSlayer.com TV commercial - File Your Taxes ASAP With TaxSlayer

Table of contents

What the TaxSlayer.com TV commercial - File Your Taxes ASAP With TaxSlayer is about.

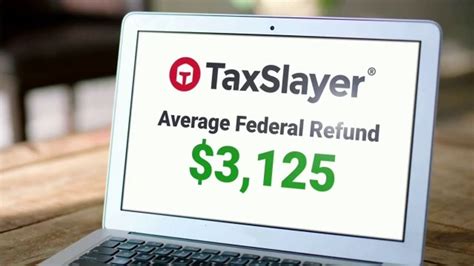

TaxSlayer.com is a provider of online tax filing services that offers a convenient and easy-to-use platform for people to file their taxes quickly and efficiently. Their latest TV spot, entitled 'File Your Taxes ASAP With TaxSlayer,' is a call to action for individuals to file their taxes as soon as possible and use TaxSlayer.com's services to make the process simple and hassle-free.

The ad begins with a person sitting at a cluttered desk surrounded by stacks of paper and looking stressed out. They are struggling to complete their tax return, and the process is causing them a lot of frustration and anxiety. Then, the TaxSlayer.com logo appears on the screen, and a voice-over urges viewers to "file your taxes ASAP with TaxSlayer."

The ad then highlights some of the features of TaxSlayer.com's online platform, emphasizing how easy it is to use and how it can help filers get their refunds faster. The ad concludes with the message that using TaxSlayer.com is the best and most efficient way to get your taxes filed quickly and accurately, saving you time, money, and stress.

Overall, the TaxSlayer.com TV Spot is a persuasive and effective advertisement that encourages people to use their services to simplify the often-complicated task of filing taxes. By highlighting the benefits of using their online platform, the ad makes a convincing argument for why people should choose TaxSlayer.com over other tax filing services.

TaxSlayer.com TV commercial - File Your Taxes ASAP With TaxSlayer produced for Tax Slayer was first shown on television on April 6, 2020.

Frequently Asked Questions about taxslayer.com tv spot, 'file your taxes asap with taxslayer'

Videos

Watch TaxSlayer.com TV Commercial, 'File Your Taxes ASAP With TaxSlayer'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Advertisers

Advertisers of the TaxSlayer.com TV Spot, 'File Your Taxes ASAP With TaxSlayer'

Tax Slayer

TaxSlayer is a software company that provides tax preparation solutions, ranging from personal income tax to large business tax filings. The company was founded in 1998 and is headquartered in Augusta...

TV commercials

Similar commercials