Annuity General TV commercial - Do You Own an Annuity?: Annuity Dos and Donts

Table of contents

- About Annuity General TV Commercial, 'Do You Own an Annuity?: Annuity Do's and Don'ts'

- Videos Annuity General TV Commercial, 'Do You Own an Annuity?: Annuity Do's and Don'ts'

- Advertisers of Annuity General TV Commercial, 'Do You Own an Annuity?: Annuity Do's and Don'ts'

- Good advertised in the Annuity General TV Commercial, 'Do You Own an Annuity?: Annuity Do's and Don'ts'

- Similar commercials

What the Annuity General TV commercial - Do You Own an Annuity?: Annuity Dos and Donts is about.

Title: Annuity General TV Spot - 'Do You Own an Annuity?: Annuity Do's and Don'ts'

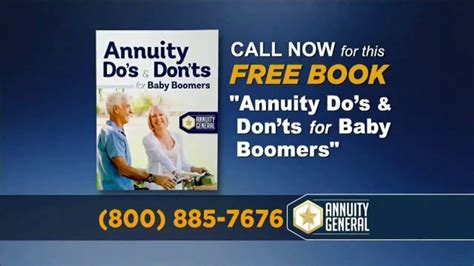

"Are you considering investing in an annuity? Or perhaps you're already a proud owner? At Annuity General, we believe in empowering our customers with knowledge and guiding them through the ins and outs of annuities."

[Cut to a split-screen shot, showing two individuals, one representing a "Do" scenario and the other representing a "Don't" scenario.]

Spokesperson: "Let's start with the Do's and Don'ts of Annuity ownership."

[The "Do" scenario shows a middle-aged couple happily enjoying their retirement, traveling the world and pursuing their passions.]

Spokesperson: "Do consider an annuity if you're looking for a reliable stream of income during your retirement years. An annuity can provide you with financial security and peace of mind."

[Cut to the "Don't" scenario, showing an individual looking worried and stressed, surrounded by piles of bills.]

Spokesperson: "On the other hand, don't rush into an annuity without understanding the terms and conditions. It's important to assess your financial situation and consult a trusted financial advisor before making any investment decisions."

[Cut back to the spokesperson]

Spokesperson: "At Annuity General, we're committed to helping you make informed choices. We've partnered with leading annuity providers to offer a range of options tailored to your specific needs and goals."

[The spokesperson holds up a brochure, showcasing the various annuity options available.]

Spokesperson: "With our expertise and personalized approach, we can help you navigate the complexities of annuities and find the one that suits you best. Whether you're seeking immediate income, long-term growth, or a combination of both – Annuity General has you covered."

[Cut to a montage of satisfied customers sharing their positive experiences with Annuity General's services.]

Customer 1: "Thanks to Annuity General, I can enjoy my retirement without worrying about my finances."

Customer 2: "They walked me through the process and found an annuity that aligned perfectly with my goals."

[Cut back to the spokesperson]

Spokesperson: "So, if you own an annuity or are considering one, remember to

Annuity General TV commercial - Do You Own an Annuity?: Annuity Dos and Donts produced for Annuity General was first shown on television on August 25, 2020.

Frequently Asked Questions about annuity general tv spot, 'do you own an annuity?: annuity do's and don'ts'

Videos

Watch Annuity General TV Commercial, 'Do You Own an Annuity?: Annuity Do's and Don'ts'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Advertisers

Advertisers of the Annuity General TV Spot, 'Do You Own an Annuity?: Annuity Do's and Don'ts'

Annuity General

Annuity General is not a specific company or entity that can be found in the search results provided. The search results mostly include information related to annuities, retirement plans, and insuran...

Products

Products Advertised

TV commercials

Similar commercials

![Unwrap a Jaguar Sales Event TV Spot, '2019 E-PACE: Maurice and Kenesha' [T2] Unwrap a Jaguar Sales Event TV Spot, '2019 E-PACE: Maurice and Kenesha' [T2]](https://tvinterviewmastery.com/image/Unwrap%20a%20Jaguar%20Sales%20Event%20TV%20Spot,%20%272019%20E-PACE:%20Maurice%20and%20Kenesha%27%20%5BT2%5D/tv)